CHANGE FACTORS AND THE FUTURE

The factors that we believe will be important for the future economic activity of the Tampere city region were identified through group interviews and document analysis, and their content was also discussed in a vision workshop (see Figure 2).

The following factors of change were highlighted as being of particular importance for the region’s economic strategy:

- Urbanisation

- The growth of the Tampere region and the youth-heavy age structure

- Regional development and domestic migration, the growth and densification of cities, the location of housing and jobs in the same areas, and economic segregation

- Internationalisation

- Tampere’s major physical and digital infrastructure projects – including the Tampere tram, Sulkavuori, Tarastenjärvi, Hiedanranta, the Deck and the Arena

- The development of a new university community

- Disruption of industry – some sectors slow down, new growth sectors emerge and new jobs are created

- Digital transformation, big data and open data

- The changing nature of work and learning, changing competences needed in working life, lifelong learning

- The reshaping of business models, including crowdsourcing opportunities, new business models based on the platform economy and sharing economy

- Increased self-employment and the needs associated with it, such as communal work spaces

- Globalisation and future changes in the world market will also have an impact on the economy of the Tampere region, especially in industry

- A diversifying security environment, the root causes of security risks: unemployment, exclusion, drug problems; the emphasis on comprehensive welfare

- Climate change, the sustainability crisis, the emphasis on environmental responsibility

The Tampere city region is one of the few growing urban areas in Finland. This growth is an indication of the attractiveness of the city of Tampere and its surrounding municipalities. However, a city with many students faces the challenge of strengthening its retention power and engaging graduates as employees, entrepreneurs and residents of the city region. The age structure, which is focused on young people, is a significant resource for the region’s economic activity and capacity for renewal. The formation of the new university community offers opportunities to reshape and intensify business cooperation and to strengthen internationally competitive competences by developing research and expertise.

The region’s major physical and digital infrastructure projects are investments in the growing region. The full exploitation of their regional effects is also important for business life. Improving regional, national and international accessibility is essential to maintaining economic competitiveness. This includes the promotion of the one-hour train connection and the development of air connections.

Promoting the competitiveness of the city region requires a diversified economic structure that is not vulnerable to changes in the world market or restructuring in one field. In industrial disruption, some sectors slow down and new ones emerge. The nature of work and learning is also changing, which highlights the need for business renewal and lifelong learning. Digital transformation enables new business models and company structures. Automation, robotics and artificial intelligence provide opportunities for more effective use of human expertise and for enhancing efficiency.

The increased diversity of the security environment underlines the importance of well-being and inclusion. Stakeholders must work closely together on both root causes and solutions contributing to the safety and security of the city residents. Answering the needs of sustainable development means making more climate-friendly decisions in the city and in business; it means supporting circular economy centres and the ecosystems of climate-smart everyday life – and seeking a better future for the well-being of people in a comprehensive way.

Conceptual basis

The economic vision of the Tampere city region, “Superior capacity for renewal – sustainable growth”, opens up a perspective on three interrelated issues: 1) developing business and innovation ecosystems, 2) the relationship between diversity and specialisation, and 3) regional capabilities.

The development of business and innovation ecosystems means identifying and supporting new forms of organisation of economic and innovation activities. An “ecosystem” is a conceptual challenge, but it inevitably highlights the importance of the relationship between the various actors in business and innovation. Ecosystems are characterised by complementary know-how and other resources of the actors and by their interdependence. Business and innovation ecosystems can be built in very different ways internally, but genuine ecosystems are united by the stakeholders’ shared understanding, at least to some extent, of common goals, development prospects or shared processes. The ecosystem approach also gives public stakeholders a new role as developers, and highlights, for example, the importance of establishing a shared vision of development.

The relationship between diversity and specialisation is one of the fundamental issues of the evolution and development of urban areas, which remains even as the forms of business and innovation organisation are changing. Regional development studies have shown that diversity is the basis for long-term development of city regions. At the same time, it is clear that the limited resources for economic development must be allocated as efficiently as possible.

Under such circumstances, it is especially important that the city region’s already complex business and innovation ecosystems interweave and influence each other’s development. For the long-term development of the Tampere city region, it is important to ensure the diversity of the economic structure and, at the same time, to support the development of traditional areas of strength in new directions. There is a particular temporal reason for this; from the perspective of long-term development, the region should have industries at different stages of their development. Economic policy must therefore identify the development paths and future needs of industries, and target industrial policy measures accordingly. These development paths include the emergence of new ecosystems around new local technologies and new core competence, the strengthening of ecosystems through foreign investment in the region as well as the diversification and internal reshaping of existing conventional ecosystems. Based on these developments, the economic strategy of the Tampere city region aims to achieve continuous renewal so that the region can adapt as well as possible to the changing operating environment, which may change very quickly.

Regional capabilities are increasingly relevant at different levels of development. At the level of the entire city region, it is vital to identify resources that will enable the region to renewal and diversify. However, the exploitation of these resources requires regional capabilities, i.e. policies, principles and processes to translate the resources (various competences and other resources) into new creative activity. The Tampere city region has highlighted the capacity for renewal as one of its core capabilities. It means, on the one hand, a conscious renewal and renewal of the region’s resources, for example through research, development and innovation, and, on the other hand, very efficient use of these resources to modernise the business life in the region.

It is useful to recognise that such capability thinking can be applied at different scale levels: at the level of the entire city region, at the level of individual identified business and innovation ecosystems and at the level of development organisations in the region. Ecosystems can be analysed particularly as assemblies of various resources and capabilities, which can therefore also be managed and developed. The same applies to the development stakeholderes themselves. The resources and capabilities through which stakeholders can best contribute to the capacity for renewal and sustainable growth of the entire Tampere city region must be identified for each organisation.

CURRENT STATE ANALYSIS

The current state analysis especially highlighted preserving the diversity of business activities, developing internationally competitive key competence and ensuring RDI investments and growth business development as factors that were particularly relevant.

The basis of the city region’s economic strategy is the economic policies of the cities and municipalities, which are reflected in their own municipal or city strategies, economic strategies or economic development programmes. The region’s strategy policies have many things in common: a favourable attitude toward business, regional cooperation, inclusion, courage, transparency, responsibility, renewal, activeness and sustainable development. Town planning that meets the needs of the business sector and a good business-customer experience are also vital.

The competitiveness of regional business requires support for the emergence of new business activities and the promotion of the reshaping of existing business activities. It requires both specialisation in the internationally competitive key competences and the preservation of a diverse business structure. In European regional development, the focus is clearly on specialisation. After the development phase, which emphasised clusters, the smart specialisation model has been brought to the core of regional development. In business-driven development, limited resources are directed toward regional strengths in a way that serves the region’s future.

The economic strategy of the Tampere city region supports specialisation by strengthening key competences and business ecosystems which allow the region to take a leading role internationally. In addition to the leading competences, the strategy will strengthen the diversity of the economic fabric of the region. It helps prevent dependence on a single industry and thus vulnerability to, for example, disruption of industry and changes in world markets.

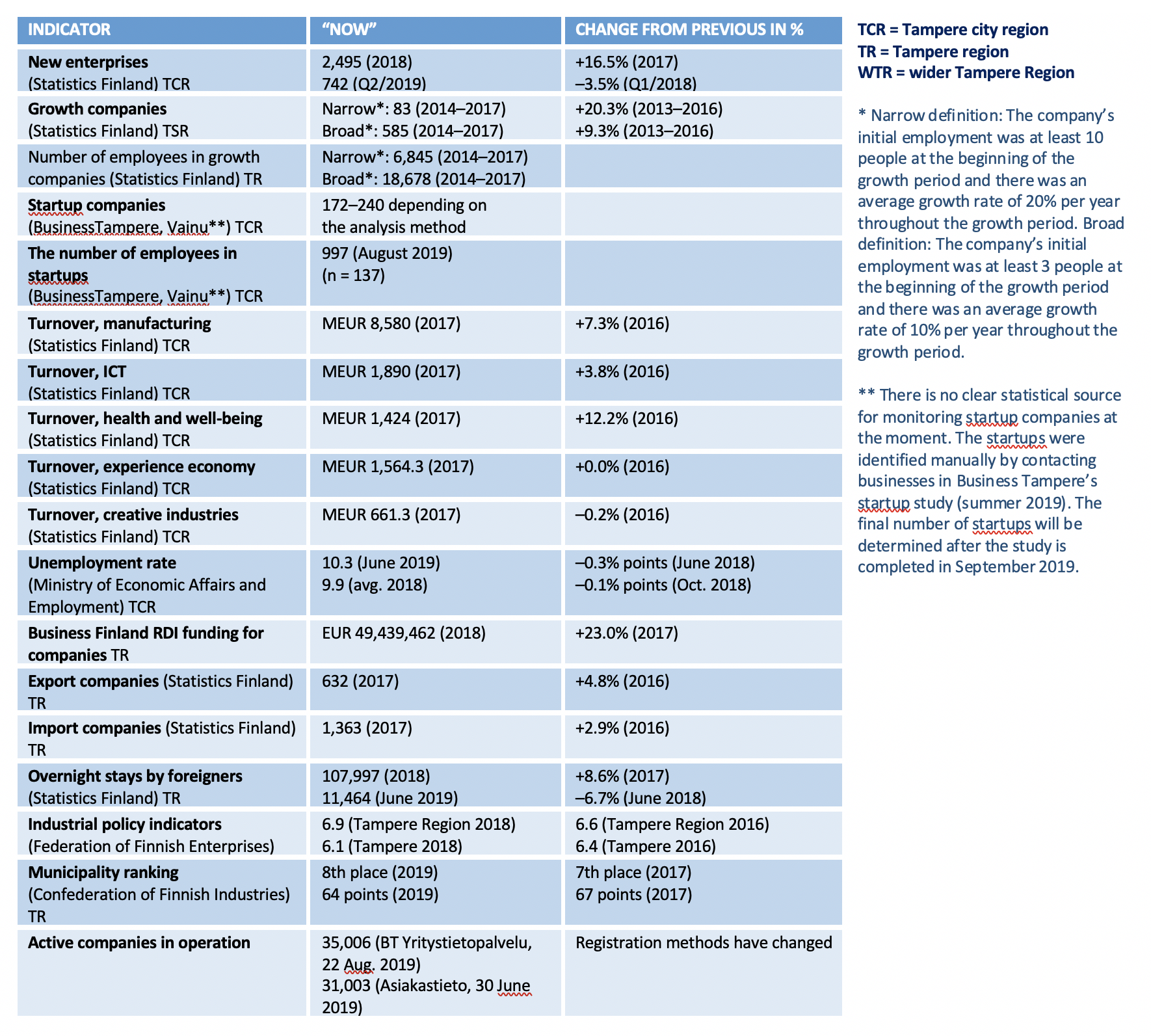

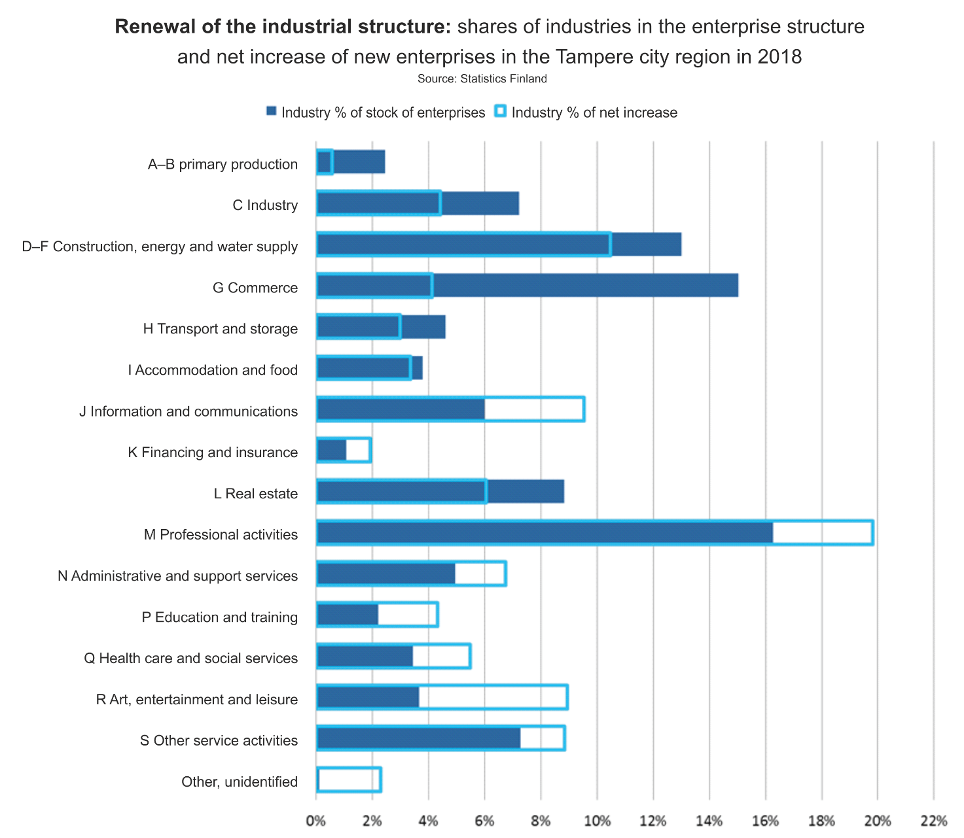

How does the current state of economic activity in the city region look in the light of statistics? The city region’s stock of enterprises now focuses in particular on professional, scientific and technical enterprises (16%; 4,000 enterprises), commerce (15%; 3,700) and construction (13%; 3,200). The share of manufacturing of the total stock of enterprises is 7% (1,800 enterprises) and that of the information and communication fields six per cent (1,500 companies)[1]. In 2018, most of the net increase of new enterprises was generated in the fields of professional activities (net increase of 206 enterprises), construction (net increase of 109) and information and communication (+99). Also in the fields of the experience economy, i.e. art, entertainment and recreation, the stock of enterprises very clearly picked up (net increase 93).

Figure 3, below, compares the industry’s weight in the current enterprise structure with the distribution of net increases for new enterprises in 2018.[2] If the relative net increase (turquoise line) exceeds the current share of the industry in the enterprise structure (blue bar), the sector has been in a dynamic state of renewal and is growing in importance in the enterprise structure of the city region.

___________

[1] Statistics Finland: Stock of enterprises Q1–Q4 2018.

[2] Business Tampere, 2019: Analysed data on the vitality of the Tampere city region, situation as at 22 August 2019.

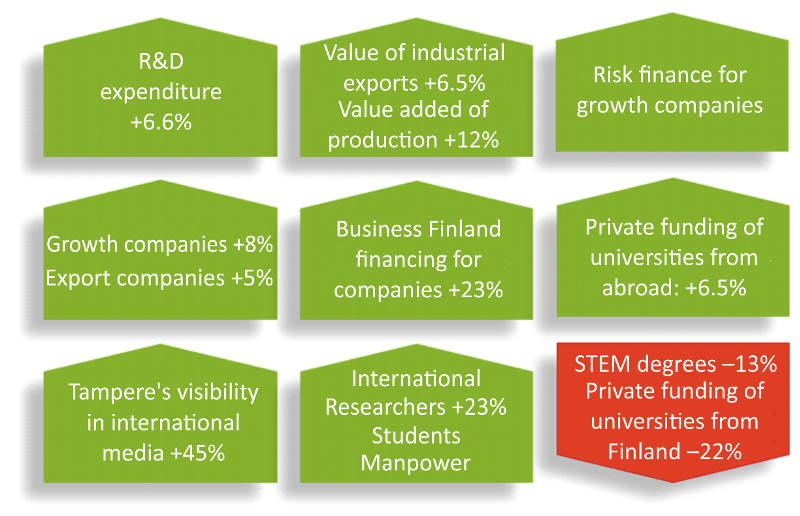

The traffic lights of the Situational Picture of Innovation in Tampere Region prepared by the Council of Tampere Region have been largely green in 2018 and 2019.[1] Several indicators of the situational picture related to the business field, such as industrial production, export value, export intensity and value added, have developed favourably. In the most recent situational picture of innovation in 2019, the number of growth companies also took a positive turn again (see Figure 4). A stronger university community has emerged and become the foundation stone of RDI activities, and the Tampere region has widely served as a platform for development and innovation. Indicators of international business connections, engagement and competence have developed mainly on an upward trend. Among other things, the importance of digital services in the economic fabric of the region continues to grow.[2]

[1] Council of Tampere Region, 2018 and Council of Tampere Region, 2019: Situational Picture of Innovation in Tampere Region. https://www.pirkanmaa.fi/innovaatioymparisto/innovaatiotoiminnan-tilannekuva/

[2] Council of Tampere Region, 2019: Situational Picture of Innovation in Tampere Region.

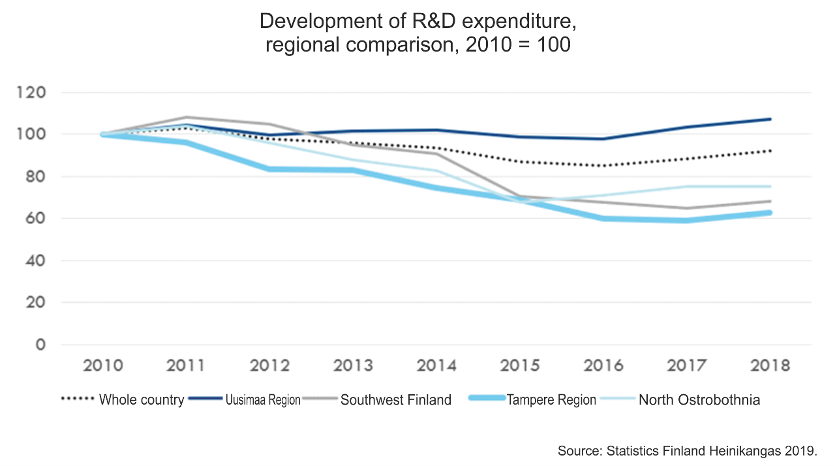

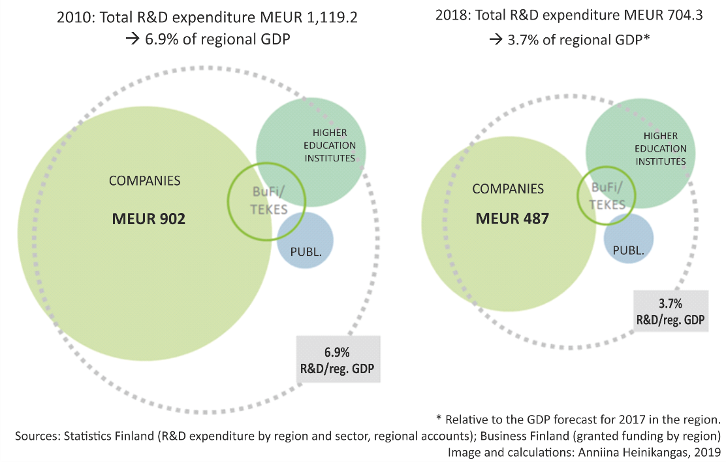

However, as the opposite trend of the many positive signals, there has been as a decade of slow growth. The expenditure on research, development and innovation, which is essential for competitiveness, has been falling for a long time, in the wider Tampere Region more strongly than in other RDI-intensive regions[1] (see Figure 5.) Last year, R&D expenditure finally started to rise in the wider Tampere Region, but there is a great deal of catching up to do Similarly, the GDP per capita has not increased as strongly as in many other regions in the 2010s. The indicators of the situational picture show both positive and challenging trends.

[1] Council of Tampere Region, 2019: Situational Picture of Innovation in Tampere Region.

The strategic objective set at national and EU level is to ensure that the RDI expenditure exceeds 4% of the regional GDP. At best, research and development expenditure in the wider Tampere Region relative to output was 7%. The ratio has now fallen below 4%. (See Figure 6). Private sector R&D expenditure, in particular, has been declining for a long time. The R&D investments in the higher education sector have developed more favourably than in the business field, and the region’s higher education institutes have been particularly successful, for example in applications for the most sought-after research funding. However, the scale of funding for higher education institutes is not sufficient to compensate for the change in the business sector.[1]

[1] Heinikangas, Anniina (2018): RDI funding 2018: RDI investment falls below national target. Council of Tampere Region. https://pirkanmaantalous.fi/innovaatiotilannekuva/tki-rahoitus-2018

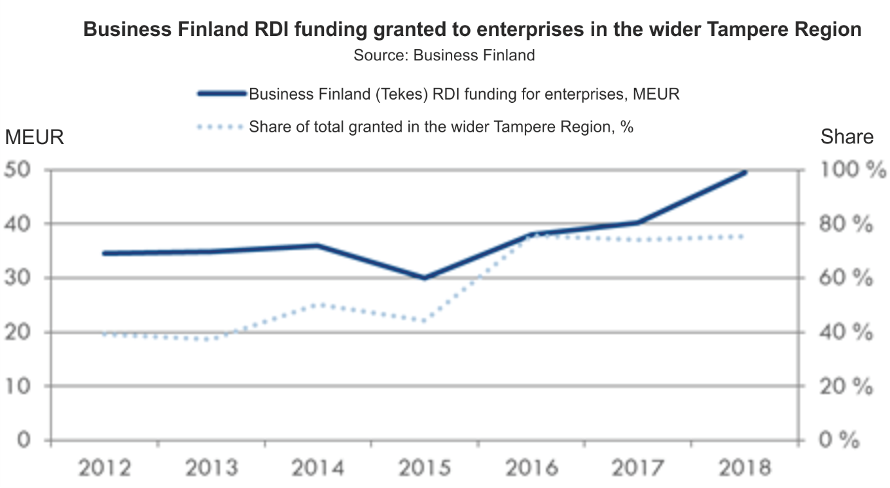

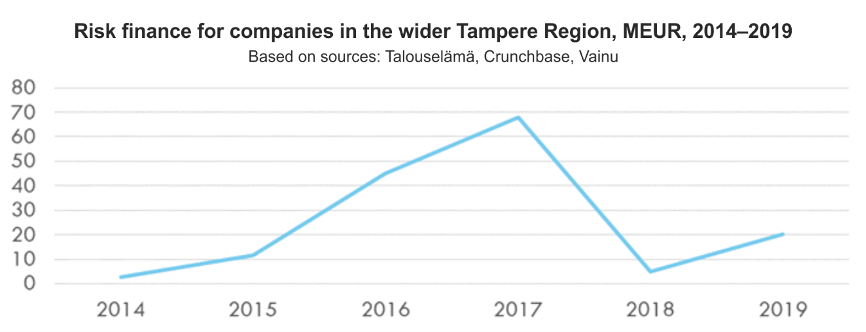

In 2018, RDI funding took a positive turn as the R&D expenditure of companies also started to rise in the wider Tampere Region. The total amount of RDI investments used in companies was MEUR 487, an increase of over 9% from the previous year. The funding granted by Business Finland in the region also increased: The total amount of RDI funding was allocated to actors in the region, totalling MEUR 66, 75% (MEUR 49) of which was allocated to the business sector. The amount increased by MEUR 9.2 from the previous year (+23%). [1] (See Figure 7). Of the funding granted, two-thirds were grants and one-third loans. In addition, a positive signal can be seen in the up-turn in risk financing granted to companies in the wider Tampere Region in 2019 (see Figure 8). The preliminary information on risk finance extends to summer 2019.[2]

[1] Business Tampere, 2019: Analysed data on the vitality of the Tampere city region, situation as at 22 August 2019.

[2] Council of Tampere Region, 2019: Situational Picture of Innovation in Tampere Region.

In the light of the strategic monitoring indicators of Business Tampere, the current state of the Tampere city region looks mostly positive. A particularly positive signal is the strong growth in the number of growth enterprises in all the company sizes in the region. There is growth is both in the number of growth enterprises in the broad definition and in the number of growth enterprises in the narrow definition. [1] Growth enterprises are most often found in construction, trade, various professional and business support services as well as information and communication. The region’s favourable demographic trends and consumer confidence are reflected in particular in strong demand from the construction and trade sectors. The active business sector is reflected in the increase in growth companies offering various professional and business services. The number of industrial growth companies has also started to grow again, reflecting the capacity of industrial sectors in the region to regenerate.[2] (see Figure 9).

[1] Business Tampere, 2019: Analysed data on the vitality of the Tampere city region, situation as at 22 August 2019.

[2] Business Tampere, 2019: Analysed data on the vitality of the Tampere city region, situation as at 22 August 2019.